Automate your appraisal workflows, reduce turn times, and manage your entire valuation process from one simple, connected platform.

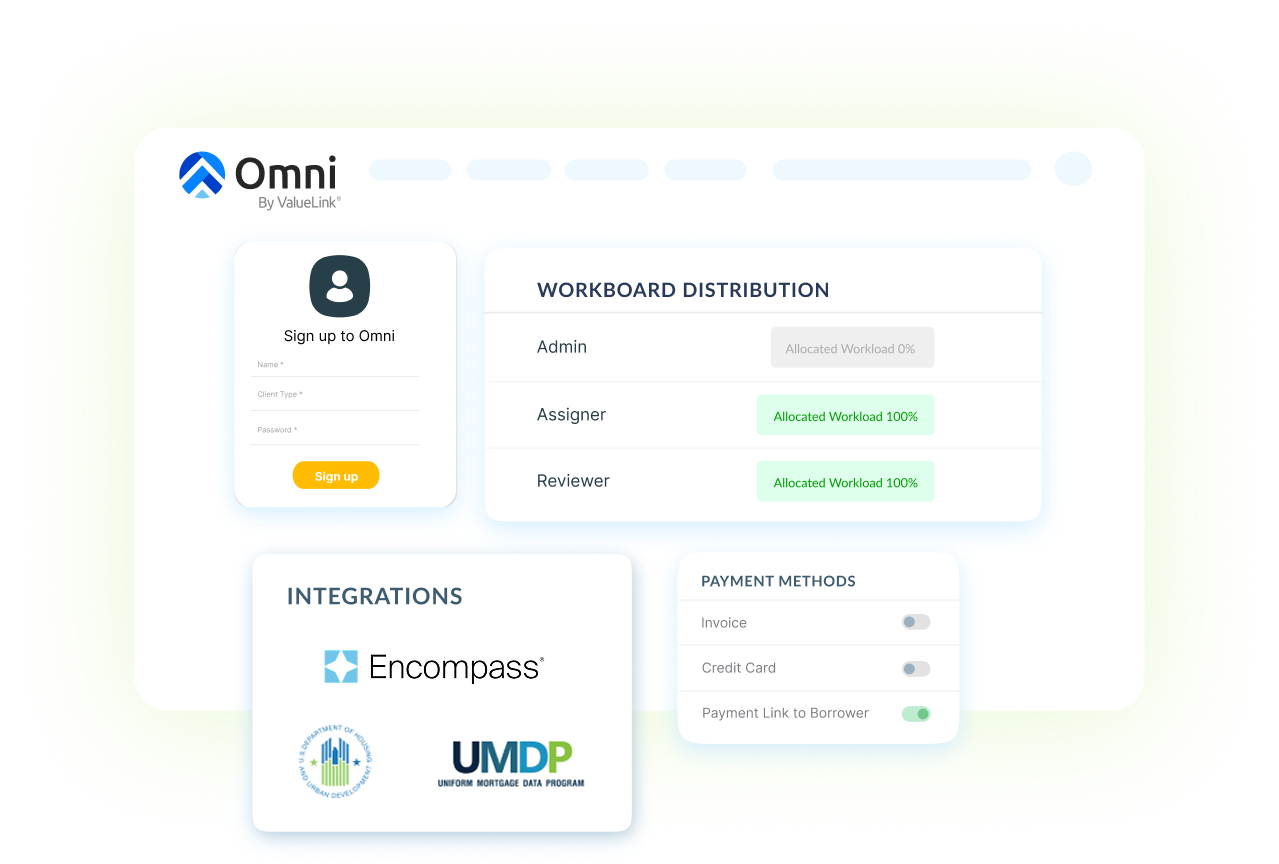

onboarding – go live instantly with zero IT dependency

Turntime reduction through end-to-end workflow management

Omni helps lenders simplify appraisal operations, from order creation to report delivery, without the complexity of legacy systems.

Omni is built for lenders scaling fast, specifically designed to remove bottlenecks, automate repetitive tasks, and accelerate closings.

Automate end-to-end workflows in 5 minutes to eliminate manual coordination between processors, underwriters, and appraisers.

Cut appraisal turn times by up to 30% with real-time visibility across every stage of your valuation pipeline.

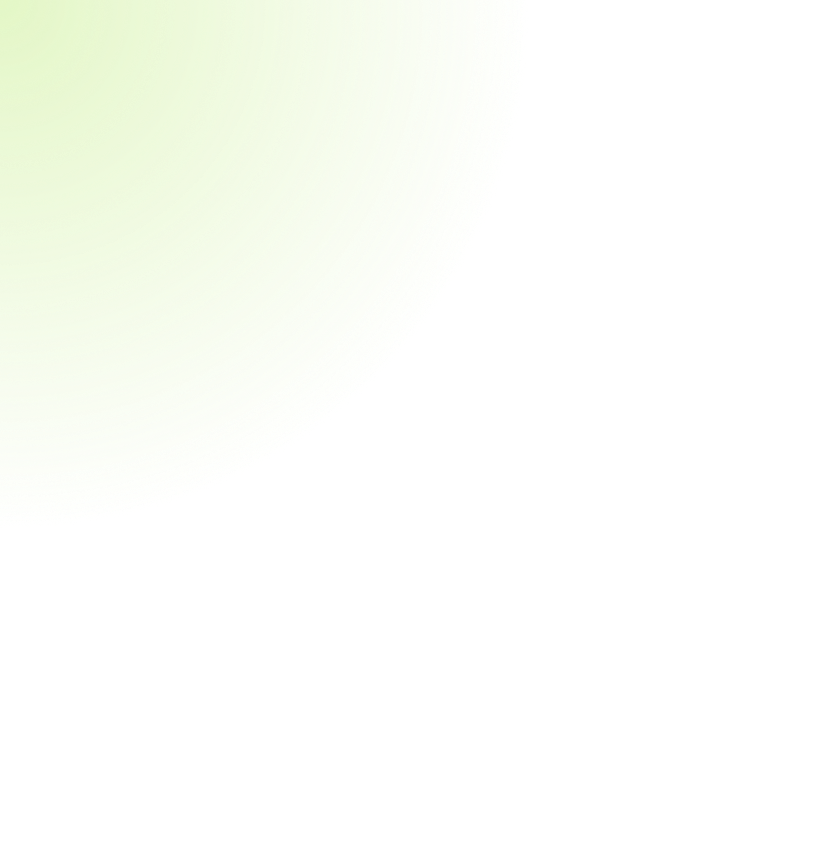

Bring order creation, tracking, review, and reporting under one roof, with data, documents, and communication fully synchronized.

Centralize your operations to replace scattered tools, emails, and spreadsheets with one unified command center.

Standardize compliance and reviews using built-in checks and configurable approval rules that protect every loan file.

Stay inside your LOS, such as Encompass, while Omni syncs borrower data, documents, and milestones automatically.

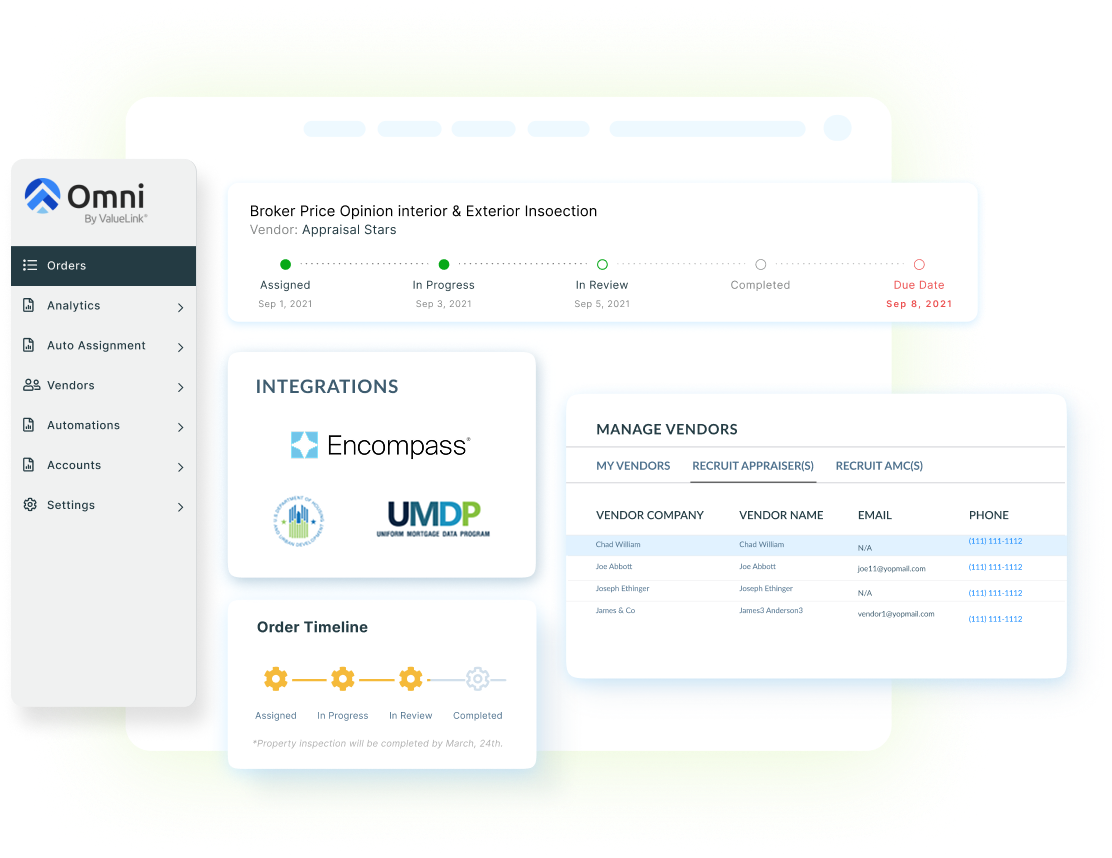

Place and track orders directly from your LOS, cutting data entry time and reducing errors.

Place and track orders directly from your LOS, cutting data entry time and reducing errors.

Grow your coverage without growing overhead, with a nationwide network of vetted appraisers and AMCs at your fingertips.

Build or expand your vendor panel instantly from 40,000+ appraisers and 170+ AMCs.

Leverage smart assignment rules to auto-match orders by geography, performance, or workload, ensuring every file moves faster.

Import orders or enter loan details in seconds. Assign manually or use Omni’s smart rules engine to auto-assign based on geography, load, or performance.

Leverage Omni’s integrated CrossCheck review to catch potential issues before submission. Automatically push compliant reports to UCDP and EAD.

Request revisions, close orders, track payments, and access real-time analytics, all within Omni’s unified dashboard.

Modernize appraisal operations without the cost or complexity of enterprise systems.

Leverage a complete end-to-end solution requiring minimal technical overhead.

© 2025 ValueLink and all related designs and logos are trademarks of ValueLink Software, a division of Spur Global Ventures Inc.