For the first time in more than a decade, the appraisal report is being rebuilt from the ground up. UAD 3.6 isn’t just a “new form”, it’s a new data standard that changes how appraisals are reported, reviewed, and delivered across the mortgage ecosystem.

This guide walks through what UAD 3.6 actually is, what’s changing (and what isn’t), the key dates you need to have circled, and how lenders, AMCs, and appraisers can start getting ready without panicking.

What is UAD 3.6, in plain English?

The Uniform Appraisal Dataset (UAD) is the standardized way GSE-bound appraisal data is defined and delivered to Fannie Mae and Freddie Mac. UAD 3.6 is the new version of that standard. It aligns the appraisal dataset with the MISMO 3.6 data standard used elsewhere in the mortgage industry, replaces today’s patchwork of major GSE appraisal products/forms (1004, 1073, 1025, 2055, 1004D, etc.) with a single flexible report, and modernizes how appraisal data is packaged and delivered (more structured fields, richer datasets, a redesigned Submission Summary Report, and a new ZIP-based delivery format through UCDP).

In other words, instead of “filling out a form,” appraisers will populate a dynamic report whose sections and fields are driven by the subject property and the assignment characteristics. That data then flows through to lenders, AMCs, and the GSEs in a much more machine-readable way.

Why is this happening now?

UAD 2.6 (what everyone uses today) was introduced around 2011. Since then, appraisal data has become richer and more digital, lenders have come to rely heavily on automated QC, risk scoring, and analytics, and COVID accelerated adoption of options like waivers, desktops, and hybrids, proving that valuation data can often be captured and analyzed without a rigid, one-size-fits-all process.

Fannie Mae and Freddie Mac frame the redesign as part of a broader “valuation modernization” effort. The aim is to take the same appraisal expertise and repackage it as structured, consistent data instead of long free-text narratives buried in addenda.

Crucially, UAD 3.6 does not change how appraisers are expected to estimate value. It changes how that work is reported and consumed.

What actually changes in the appraisal report?

One dynamic report instead of many static forms

In the current world, a lender or AMC chooses a specific form number (1004 vs 1073 vs 2055) and then makes that form fit the property. In the UAD 3.6 world, the subject property and assignment characteristics drive the report layout. A single redesigned Uniform Residential Appraisal Report (URAR) can handle condos, SFR, 2–4 units, manufactured housing, co-ops, updates, and completions by turning sections on or off based on what is actually relevant.

That means fewer form-selection headaches and fewer “shoehorned” edge cases, such as site condos or properties with unusual outbuildings that never felt like a clean fit on older forms.

More structured data, less free text

A core goal of UAD 3.6 is to turn today’s free-form commentary into discrete, standardized data wherever possible. Instead of relying on scattered narrative comments, more of the report is captured as defined data elements. Property characteristics like site, exterior, interior, and additional structures are captured in richer, standardized fields. Quality and condition ratings still use familiar scales (Q1–Q6, C1–C6), but they are backed by more detailed, objective definitions. Room-level and system-level details, including certain energy and efficiency features, move out of generic prose and into fields that are easier to analyze, compare, and score.

For reviewers, that means less time hunting through addenda and more time acting on clearly labeled, filterable data points.

Reorganized sections and tighter link between data, photos, and commentary

The redesigned report groups data, images, and commentary by topic. Site, improvements, additional structures, sales comparison, and rental analysis each have their own section. Photos and comments that relate to a given topic sit with the data for that topic instead of being scattered across the report or buried in the back.

If you are looking at site issues, you stay in the site section with all the information you need in one place. The same is true for exterior, interior, additional structures, and so on. That makes both human review and automated QC more straightforward.

New delivery format: ZIP package and redesigned SSR

Under UAD 3.6, the appraisal delivered through UCDP is no longer just a single XML file. Instead, the standard delivery becomes a ZIP package that contains the XML data file, a human-readable PDF, and all associated images and exhibits.

The Submission Summary Report (SSR) is also being redesigned to surface more relevant quality and eligibility information, and it will be available in both PDF and JSON formats. That makes the SSR easier to feed into automated workflows, risk tools, and internal reporting, instead of being something that lives only as a static PDF.

Better built-in checks

The GSEs are introducing a compliance or validation API so appraisal software can check a report against UAD 3.6 data rules before submission. That means the software can confirm that required fields are present, data types are valid, and basic format expectations are met before a file ever hits UCDP.

For lenders and AMCs, that should reduce the volume of avoidable defects and revision requests driven by missing or miscoded data, and let reviewers focus their attention on more substantive issues.

How does UAD 3.6 change the appraisal workflow?

For Lenders

Operationally, lenders will feel UAD 3.6 in a few core areas. Ordering and product selection will move away from choosing a form number and toward specifying property and assignment characteristics, such as whether the appraisal is traditional, desktop, hybrid, or exterior-only, and which property type and program are in play. LOS and integration updates will be required so platforms like Encompass, MeridianLink, Empower, and others can handle the new dataset, file types, and ULDD Phase 5 requirements. QC and review workflows will gradually shift to be more data-driven, using richer structured fields and redesigned SSR output for rules and analytics, instead of relying purely on manual “form reading.”

Day-to-day, reviewers will still be looking at a familiar narrative arc, subject, comps, reconciliation, but the labels, screens, and data elements they work with will look and behave differently.

For AMCs

AMCs sit in the middle of this change and will need to manage it from both directions. On the supply side, they must ensure that their panel appraisers have UAD 3.6-ready software and understand the redesigned report structure. On the demand side, they must align lender product naming and requirements with what appraisers will actually deliver under the new dynamic form model.

Their internal QC and pre-delivery checks will evolve as well. With more structured data available, and with appraiser-side compliance checks catching basic issues earlier, AMCs can tighten their own review rules, reduce back-and-forth, and send cleaner files downstream.

For Appraisers

For appraisers, UAD 3.6 is first and foremost a reporting and data-entry shift. The fundamentals of valuation: understanding the market, choosing comps, analyzing risk factors, and producing a supportable opinion of value; do not disappear.

What changes is how that work is captured. Appraisers will work with updated software and training modules to produce the redesigned report, fill more structured fields and rely less on “I’ll explain it in an addendum,” and link what they observe on site more cleanly to data, photos, and commentary in specific sections. Over time, the GSEs expect the role of the appraiser to lean even more heavily into analysis and judgment, while data collection and validation become more standardized and better supported by tools and automation.

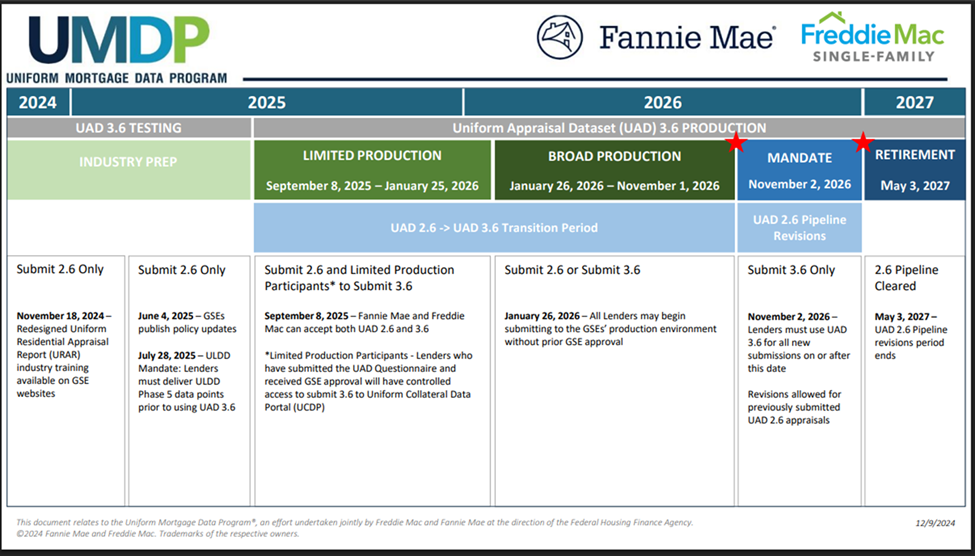

Key UAD 3.6 dates you should know

The timeline is long, but the milestones are clear. These are the dates most organizations should have in their project plans, with each date bolded here for clarity.

Figure 1 Source: https://sf.freddiemac.com/docs/pdf/uad_joint_announcement_oct_2024.pdf

November 18, 2024 – Training begins

Training materials for lenders, AMCs, and appraisers go live via the GSEs’ UAD & Forms Redesign resources. This includes a roughly four-hour, seventeen-module course for lenders and other stakeholders. It is the first formal chance for teams to see the redesigned report structure in detail and understand the new data elements.

June 4, 2025 – Policy updates published

Fannie Mae and Freddie Mac issue updated Selling Guide and Seller/Servicer Guide language aligned to UAD 3.6 and the redesigned URAR. This is where the “rules on paper” catch up with the new data standard, and it is a natural moment for lenders to begin updating internal policies and procedures.

July 28, 2025 – ULDD Phase 5 mandate

Lenders delivering to the GSEs must now use the updated Uniform Loan Delivery Dataset (ULDD) Phase 5. This loan-delivery update is a prerequisite for full UAD 3.6 adoption, so many LOS teams treat this date as a hard dependency in their implementation plans.

September 8, 2025 – January 25, 2026 – Limited production

A select group of lenders and vendors enters a controlled rollout of UAD 3.6, often referred to as limited production. Most of the industry stays on UAD 2.6 during this window, but the participants help surface real-world issues in ordering, review, and delivery workflows while the old and new standards run side by side.

January 26, 2026 – November 1, 2026 – Broad production

All lenders can now choose to use UAD 3.6. This is the dual-path period where both UAD 2.6 and UAD 3.6 are available. Some organizations flip entirely to the new standard, while others phase it in by channel, product, or investor. It is also when many QC and technology teams refine their rules and reports based on live production data.

November 2, 2026 – UAD 3.6 becomes mandatory

From this date forward, new appraisals delivered to the GSEs must use UAD 3.6. UAD 2.6 remains available only for revisions or updates to reports that were originally delivered under the old standard. Any new assignments headed to the GSEs must be on the new dataset.

May 3, 2027 – UAD 2.6 fully retired

The grace period for revising legacy UAD 2.6 reports ends. After this date, UAD 3.6 is the only supported standard for GSE-bound appraisals, and any remaining internal or vendor processes still tied to 2.6 need to be fully decommissioned or isolated to non-GSE business.

Common misconceptions about UAD 3.6

As teams start planning for UAD 3.6, a few misconceptions tend to surface repeatedly.

One common misconception is that “it’s just a new appraisal form.” In reality, UAD 3.6 is a new dataset plus a redesigned dynamic report. The move to MISMO 3.6 alignment, structured fields, ZIP-based delivery, and a redesigned SSR is what unlocks better automation and analytics. The PDF itself is only the tip of the iceberg; the real shift is in how the underlying data is defined and transmitted.

Another misconception is that this change “replaces human appraisers.” The GSEs have been clear that valuation modernization adds more options, waivers, hybrids, desktops, and modern data standards, but it does not remove appraisers from the risk process. If anything, as more data becomes standardized, the value of an appraiser’s judgment and analysis increases, because the mechanical checks can be handled by systems, leaving people to focus on edge cases and higher-risk scenarios.

A third misconception is that “we can wait until late 2026 to worry about it.” Technically, organizations could delay active work until closer to the mandate, but that compresses system updates, vendor coordination, policy changes, and staff training into a very small window. The limited and broad production phases exist specifically so lenders and AMCs can learn, test, and refine over time, not scramble at the finish line.

Finally, it is easy to assume that “this only affects the appraisal or collateral team.” In reality, UAD 3.6 touches LOS administrators, secondary and delivery teams, QC and risk, compliance, and even BI and analytics. Anywhere appraisal data is consumed, stored, or reported will need at least some attention, because the shape of the incoming data changes.

How to start getting ready (without going down a rabbit hole)

You don’t have to re-engineer everything today. But a few smart moves now will make the transition far less chaotic later.

Educate your core stakeholders

Start by identifying the people who will actually touch UAD 3.6 day to day, such as your appraisal operations or AMC-relations team, your QC and collateral risk group, and the LOS and integration team that owns your tech stack. Share the official UAD & Forms Redesign hub and the Lender Readiness Kit with them and encourage them to work through the training modules, which walk section by section through the new report and dataset.

Even a small internal “study group” that understands the new standard at a deeper level will pay off when you begin to change systems and policies.

Map where appraisal data flows in your organization

Before changing anything, draw a simple picture of today’s world. Note where appraisal orders originate, which systems receive appraisal data (LOS, appraisal platform, QC tools, data warehouse), and where SSRs are viewed or stored.

That current-state map does not have to be fancy. The goal is to make it obvious which processes, integrations, or reports will be affected once UAD 3.6 files start to arrive, so you can prioritize and sequence your work.

Talk to your key vendors early

Once you know your own landscape, talk to the vendors who sit in the flow of appraisal data. Ask your LOS provider, appraisal platform, QC or analytics vendors, and any other key partners for their UAD 3.6 roadmap and testing timelines. Clarify when they will support limited and broad production and what will change in file formats, field mappings, and user experience.

The GSE timelines are fixed. Your goal is to understand when each partner will be ready, so you can plan pilots, training, and cutovers in a way that matches both your risk appetite and your internal capacity.

Decide how you’ll handle the dual-path period

Between early 2026 and the mandate on November 2, 2026, you will have both UAD 2.6 and UAD 3.6 in play. Some lenders will flip entirely to the new standard as soon as their systems and vendors are ready. Others will phase it in by channel (for example, conventional only), geography, or product type.

It is worth discussing how you want to approach that window. Think about how you will track which standard a given loan is on, how you will handle revisions to legacy 2.6 reports, and how you will make sure reporting and analytics remain consistent while both formats are flowing through your systems.

Bringing it all together

UAD 3.6 is a big shift, but its goals are straightforward: clearer and more standardized data, faster and more consistent appraisal reviews, and better alignment between lenders, AMCs, appraisers, and the GSEs.

If you understand what is changing, who it affects, and the key dates ahead, you are already ahead of most of the market. From here, the next step is to turn that awareness into a simple readiness plan: educate the right people, map your data flows, sync with your vendors, and sketch out how you want to handle the transition phases.

And when you are ready to turn UAD 3.6 from “new requirement” into “real operational advantage,” modern appraisal workflow platforms like ValueLink can help you plug these changes into your processes without starting over from scratch.